The purpose of this report is to analyze the viability of investing in digital currencies and to argue that people should invest in them for the long term. Currency is a virtual currency protected by encryption, which prevents double spending on a distributed network. In today’s world, there are over 1600 cryptocurrencies that can be utilized to make financial transactions. Some digital currencies, including bitcoin, bitcoin cash, LTC, LINK, and tether, are built on a decentralized network, such as blockchain technology. This is a distributed ledger enforced by the network’s many nodes.

There is an immense need to invest in digital currency as it’s the desire for a long-term, reliable repository of value. Unlike flat money, most digital currencies have a finite quantity that is determined by mathematical algorithms. Any political entity or government agency will be unable to dilute its values through inflation as a result of this. A government agency can’t tax or confiscate tokens without the owner’s permission due to their cryptographic nature. A government agency can’t tax or seize tokens without the owner’s consent (Bordo et al., 2017)

Defining the target audience of the digital currency is a tall task considering the epic rate of expansion. Most of its users are millennials. The studies show that at least 35 million people use bitcoin wallets for their transactions (Boar, 2021). The average age of a crypto trader is 25 to 34, with the 35 to 45 age group coming in second. Although the majority of customers are male, female investors are currently doubling every two months or so. People from many walks of life, from low-tech to high-tech.

Egold (digital currency) was the first extensively used internet money, debuting in 1996 and quickly growing to several million users until being shut down by the US government in 2008. Any cash, money, or money-like assets that are largely handled, saved, or exchanged on a digital computer system, particularly over the internet, is referred to as digital currency (Grinberg, R., 2012). Digital currencies, unlike currencies with printed banknotes or minted coins, offer similar characteristics to traditional currencies but do not have a physical presence. The lack of a physical form allows for near-instantaneous internet transactions and removes the costs of sending cash and coins. Although it is not legal tender, it does allow for the transfer of ownership between government entities.

Digital currencies can be traced back to the 1990s dot-com boom. Liberty Reserve, a well-known digital currency that was introduced in 2006 and allows users to convert dollars or euros to Liberty Reserve Dollars or euros and freely exchange them with others for a 1% fee, is another well-known digital currency. In 1983, David Chaum suggested the idea of digital money for the first time. He started Digi Cash, a digital currency company (Chaum, D., 2012). PayPal launched its services in 1990. In 2009 bitcoin was launched which marked the start of decentralized blockchain-based digital currencies with no central server and no tangible assets held in reserve. Block-chain-based digital currency proved resistant to attempts by the government to regulate them because there was no central organization or person with the power to turn them off.

Why people should invest

- The digital money which people invest, always remains their own. If a person put the digital money into an e-wallet he will be absolutely sure that no one is going to rob or steal it.

- Crypto coins are decentralized and do not involve any government transaction and extra. It has Low fees for Transactions. The investor has all the power in his money. Cryptocurrencies that do not depend on fat money fluctuations and no third party is likely to be a part of one’s e-wallet.

- Every bitcoin transaction is monitored and recorded in a public ledger known as the block chain. Once a transaction is confirmed in a digital system, it cannot be modified, making it the most transparent. One can conduct transactions at any time using the digital currency system. It makes no difference where you are; all you need is the internet to connect. A person can even conduct business using your mobile phone. The owner of a digital currency has complete control over his or her funds and transactions. Keeping everything secure and private (Boar, 2021). Every transaction is unaffected by the names of the individuals or parties involved. One of the most appealing aspects of investing in digital currencies is the enormous potential for growth and gain.

- By the general knowledge of cryptocurrencies, trending and the market situation at large provide people to invest intelligently and gain financial growth. There is potential to secure long term safe investment decide the amount of investment and draft a strategy (Kiff J. et al., 2020)

- By choosing a trader or a consulting company to support in all stages, performing the analysis, mitigating, and identifying the most efficient strategy help in profitable investment.

People are afraid of investing

- People are afraid of investing in digital currency as it is not a physical asset. Bitcoin is a means of exchange, a unit of account, and a store of value, but it is also used to price and settle various goods and services. Bitcoin is not universally accepted as a unit of the amount and mean of payment (Gilbert et al. 2018). Cryptocurrencies have neither an income stream nor practical use. Bitcoin trading suffers usually from illiquidity and manipulation because of the existence of whale wallets.

- One of the most serious issues with digital currency is the scaling issue. While the number of digital currencies and their usage is growing, it is still dwarfed by the number of transactions that the payment giant conducts every day. Because it is a digital system, it will be vulnerable to cyber-attacks and could fall into the hands of hackers. Also, it is not regulated by any regulated body or any bank. It is store in a digital wallet that may not be retrievable as there is no central authority figure. As it exists in digital form and has to be stored in a digital wallet that may not be retrievable as there is no central authority figure.

- By investing in digital currencies carry the risks such as loss or destruction of a private key, another cyber-security risk including malicious activity and risks associated with the peer-to-peer transaction.

- Another insecurity in investing in crypto is regarding its legality. Many countries around the world has banned it. People are afraid of losing their assets.

Evaluation of investment in digital currency

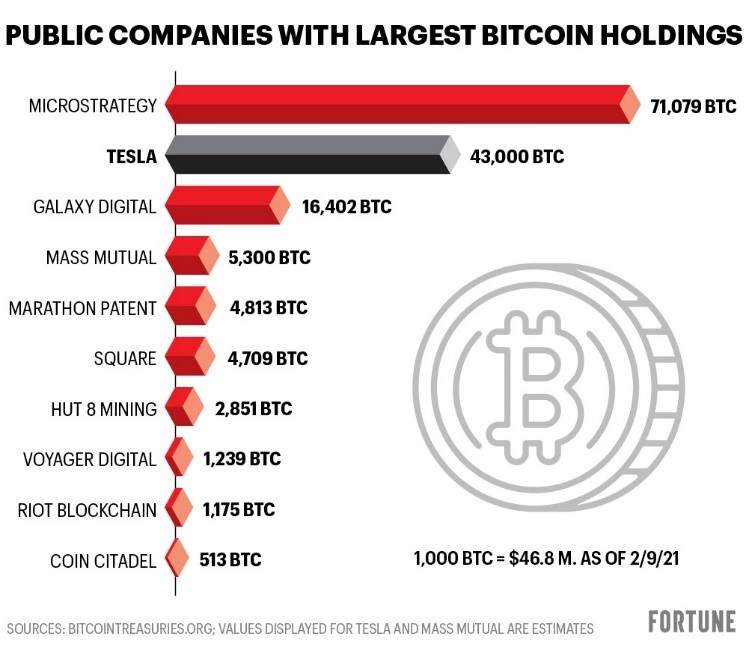

People should invest in digital currency as it provides a transparent form of transaction as it is tracked and stored on a distributed ledger known as the block chain. The facility is accessible 24 hours a day, seven days a week, making it a convenient way to spend money. Digital currency markets are establishing and many companies gaining direct exposure to the digital currency sector (Ferrari, 2020). Financial giants such as square and PayPal are making it easier to buy and sell digital currency on their popular platform. People should invest in digital currency due to the longing for reliability, in the long run, the store of value because it has a limited supply, capped by a mathematical algorithm. It is difficult for any political organization or government agency to degrade its value through inflation and will save from money laundering in the country.

Digital currencies are part of the new and rapidly evolving digital assists industry which itself is subject to a high degree of uncertainty. These are not backed by a central bank; rather, they are issued by national and international organizations, and their value is established solely by market forces. There are significant inconsistencies among various regulators with the legal status of digital money. Regulators are concerned that bitcoin and other digital currencies may be used by criminals and terrorist organizations.

Investment in digital currency carries both advantages and disadvantages but the advantages outweigh the risks.it is used by a lot of people as a separate source of income by trading or investing. The value of digital money increased with time and most likely it will continue to rise in the future.so if you invest in cryptocurrency today, you might realize that it was a smart investment in the future.

Besides all risks, it is a very efficient means of investment that increased the value of assists. The market capitalization of digital currencies has nearly quadrupled to $764 billion. Apart from bitcoin, the total value of all digital coins increased by more than 270 percent from $60 billion to $225 billion. Best contenders for the best crypto to buy in 2021 are bitcoin, bitcoin cash, cosmos, and Ethereum, etc.

- Investment become secure by applying laws and principle similar to the stock exchange and also performing the technical analysis enabling to calculate the risks which determine the right time for the investment

- To pick the right and suitable strategy for the investment with the consultation by the experts can secure the investment and enhance the chances to gain a high profit by investing at right time.

- By the installation of payment kiosks in the street and the use of new money storage tools can improve the accessibility of digital currencies.

- There is a need to make and enforce the regulations preventing or restricting the trading of digital currencies.

- By working with digital currencies, the holder should have a stronger password or key.

- Should keep the stronger key in mind when interacting with trustworthy cryptocurrency wallets, exchanges, brokerages, and mobile apps. I didn’t tell anyone about the secret key. Also, avoid utilizing a wallet that is hosted by a service. Security for digital wallets should be approached in a mixed manner.

- Protect yourself from mobile phishing and learn about the many ways and procedures for safeguarding your digital currency