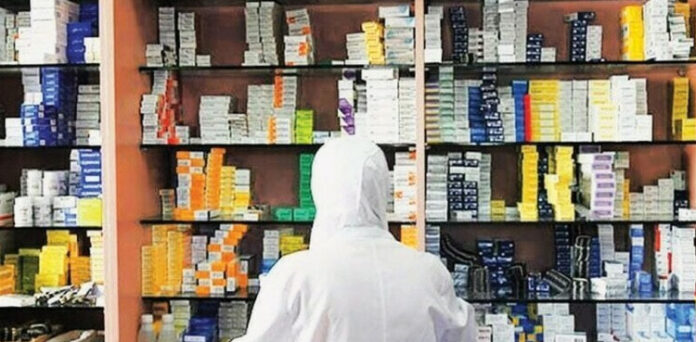

The Ministry of National Health Services, Regulations and Coordination (NHS, R&C) official, the government has proposed an 18 percent sales tax on medicines in the next budget on the recommendation of the International Monetary Fund (IMF).

Experts warned that medicine prices will become out of reach for many people with the imposition of 18 percent GST. The step will allow pharmaceutical companies to set and sell medicines at prices of their choice, they say.

It is pertinent to mention here that the IMF’s recommendation for taxing medicines comes at a time when the previous caretaker government had already deregulated medicine prices.

Earlier it emerged that the International Monetary Fund (IMF) and Pakistan will begin policy-level talks on the bail-out package today.

The Fund had asked Pakistani authorities to impose tax on monthly pensions exceeding Rs 100,000.

The monetary fund demanded stringent economic measures for new loan program and legislation aimed at taxing wealthy pensioners. IMF asks Pakistan to ‘impose’ tax on monthly pensions

According to sources, Pakistan has no alternative plan to the IMF loan program, and the government will need to implement the agreed-upon reforms to secure the loan.

Sources said that the new program aims to reduce subsidies from Rs 1,550 billion to Rs 800 billion and limit gas subsidies.

Additionally, electricity prices may also increase by 10-12%, and retail businesses will be required to document sales and prevent tax evasion, sources added.