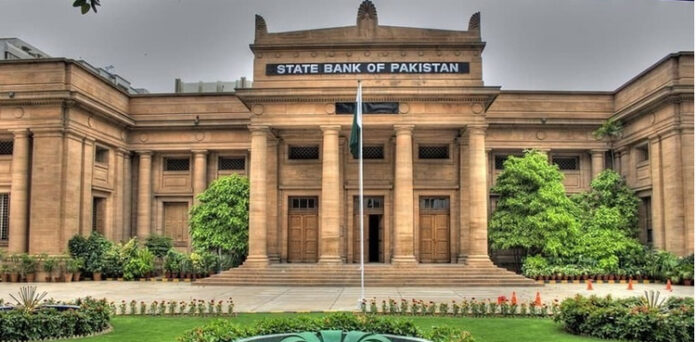

Governor SBP Jameel Ahmad is set to announce monetary policy, with the market anticipating a second straight interest rate cut.

Currently, the interest rate is 20.5 percent, while the market experts are hopeful that the rate will be slashed 100 to 150 basis points.

The inflation rate in June 2024 was recorded at 12.6 percent, while the current account deficit was $410 million.

High-net-worth people and financial institutions were surveyed recently by Securities Broking and Investment Banking organizations, and the results indicated a strong expectation for a large rate drop.

SBP slashes interest rate to 20.5pc

Notwithstanding a minor increase in the current account deficit and exclusion from the offshore bond market, JP Morgan also anticipated that the EFF will grow foreign reserves. Recent policy-based loans from the World Bank and ADB are considered a major vote of confidence in Pakistan’s creditworthiness, as is the case with the new EFF.

Earlier on June 10, the SBP slashed the interest rate by 150 basis points (bps) to 20.5 percent.

The SBP Monetary Policy Committee (MPC) noted that “underlying inflationary pressures are also subsiding amidst tight monetary policy stance, supported by fiscal consolidation”.

At the same time, the MPC highlighted “some upside risks to the near-term inflation outlook associated with the upcoming budgetary measures and uncertainty regarding future energy price adjustments”.

Mutib Khalid is a skilled content writer and digital marketer with a knack for crafting compelling narratives and optimizing digital strategies. Excel in creating engaging content that drives results and enhances online presence. Passionate about blending creativity with data-driven approaches, Mutib Khalid helps brands connect with their audience and achieve their goals.